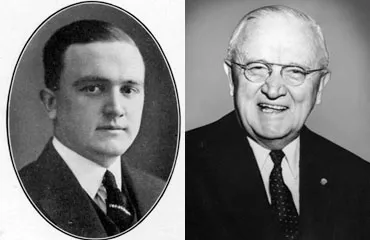

Thomas McCabe '15 Recognized as Visionary Business Leader Who Transformed Swarthmore College

Investor's Business Daily: Thomas McCabe Got Scott Paper On A Roll

It didn't take a business genius to see Thomas McCabe's potential. A natural salesman and bold thinker, he rose quickly through the ranks after joining Scott Paper in 1916 as a $10-a-week salesman. But even Scott's biggest boosters had to be surprised when he turned a sleepy, one-mill company in Chester, Pa., into a multinational concern with 40,000 employees and 60 manufacturing plants in 19 countries. Annual revenue rose from $6 million to more than $2 billion on sales of such products as toilet paper and paper towels during his 39-year stewardship. Scott Paper merged in 1995 with Kimberly-Clark, which until early this month was on a 100% stock run since 2009.

A tall and genial man, McCabe (1893-1982) also became a major figure in national affairs, serving two presidents in critical posts. During World War II, he worked in lend-lease and war production. Then in the postwar years he headed the Federal Reserve Board during a tumultuous era. In that position, McCabe was credited with the introduction of America's first monetary policy. ...

At Swarthmore College in Pennsylvania, McCabe studied economics, played varsity football and joined the Delta Upsilon fraternity, where he met Arthur Scott, Sr., a DU legacy and Swarthmore graduate who lived nearby. Scott recruited McCabe in 1916 to work for the firm his father had founded in 1879.

After a year with Scott, McCabe joined the Army as a private in 1917. He was stationed in Newport News, Va., where he handled logistics for ordnance and other military supplies and rose to the rank of captain by the end of War War I. Returning to Scott, he rose like a banshee - division sales manager in 1920, company sales manager in 1922, vice president in 1927 and, in 1928, chief executive, a position he relinquished in 1962 to become chairman of the board. McCabe's first move as top dog was to expand the company, buying a private mill in Nova Scotia to kick off a long-term acquisition policy.

"That's when he decided to take it to a completely different level," said Jeannette McCabe Harris, his granddaughter. "He had obviously the gumption to want to grow the company." ...

McCabe's creative leadership also helped change the way American universities invested their money. As chairman of the Swarthmore Investment Committee for more than 25 years, he enriched the school with common stocks.

College Cash

"Right after World War II the investment mentality was generally mostly conservative, concentrating on fixed-income securities and molded by the experience of the crash and Great Depression,'' Kendall Landis ['48], former vice president of development and alumni relations at Swarthmore, said during a remembrance following McCabe's death. "Swarthmore in those early years had a very modest endowment. McCabe had faith in the American economy for the long term. By about 1950 he had moved about 50% of our endowment into blue chip equities.'' ...

In 1952, McCabe endowed his first scholarships to Swarthmore. Because he lived just a few blocks from campus, he often strolled the blocks, and he rarely missed a football or baseball game.

"I have a very close relationship with students,'' he said in his later years. "I think my greatest form of relaxation is walking, particularly on the college campus, talking with students, many of whom are on my scholarships. I can personally testify that each year the standards of youth become better. ... I am betting all that I own and possess on them. My only regret is that I'm not 50 years younger to watch them attain their potentialities and lend them a hand in their work.''

At Swarthmore College, Thomas McCabe '15 established the Thomas B. McCabe '15 Awards, which has provided a minimum of full tuition to 335 students to date, and contributed the Scott Amphitheater and the Thomas B. and Jeannette L. McCabe Library.